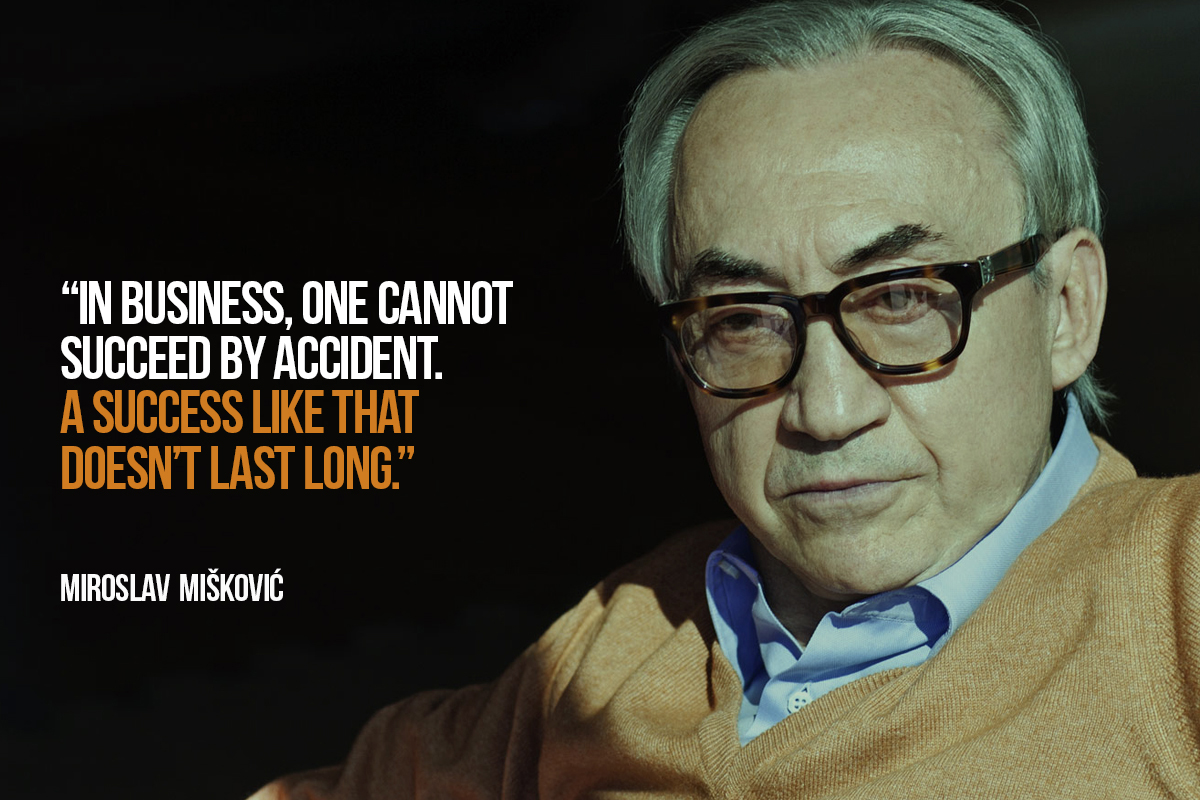

Short overview of the closing arguments, of the lawyer Z.Tomanovic, the defence counsel of Mr Miroslav Miskovic:

“I see acquittal as the only possible outcome of this case, and as the arguments to this thesis, I am referring to the following:

The prosecution demands years in prison for my client, at its own impression, and imposing their beliefs and their logical thinking. However, when we appear before the court, at the base of every belief and every logical thinking, both of the prosecution and court, there must be clear evidence. An evidence without belief and logic can lead to an acquittal, but on the other hand, belief without evidence and logic can never lead to a conviction. Evidence is a measure of judicial truth and the essence of any court decision.

Lack of evidence against my client regarding the criminal offense of tax evasion is best illustrated by the very attitude of the law enforcement authorities towards Miskovic. Namely, neither Tax Administration nor the Ministry of the Interior have ever filed reports against Miskovic, i.e. they have never filed any criminal charges. In the indictment that served as the base for your trial to Miskovic, there is not a single sentence about the reasons as to why the prosecution considers that there are evidence for his being guilty of tax evasion. In the second most important document of the prosecution, in support of indictment for tax evasion, the name of Miroslav Miskovic is not even mentioned, that is, the prosecution failed to present a single evidence for Miroslav Miskovic.

With such an approach in the hearing procedure, instead of contesting the presumption of innocence, the prosecution demands a verdict based on implications, assumptions and circumstantial evidence. The Prosecution considers that if Mišković provided advice of business nature to everyone including his son, then it only goes without saying that he advised his son to commit criminal offense.”

The prosecution finds basis for such view in a strong campaign led by the media and the political elite in Serbia publicly imposing the notion on Miskovic’s guilt, on the existence of evidence that he had committed a crime and that have shaped public opinion that everything is clear, that Miskovic’s guilt is implied and that we are only waiting for the level of penalty.”

Mišković does not have the assurance from the court that he is on par with other citizens. Instead of evidence, the prosecution has created the illusion that there is evidence of his guilt.

Speaking in the language of law Mišković must be acquitted of criminal offence of tax evasion, at least because:

• The objective identity of the accusation does not constitute an act of aiding and abetting in committing a criminal offence of tax evasion.

• It is not proven that the defendant carried out the actions with which he was charged.

• It is not proven that the defendant acted in the time and the place for which he was charged.

• It is not proven that the alleged advice also contain the awareness of all the characteristics of criminal offense.

• It is not proven that the defendant acted neither with possible, nor with direct intent.

• It is not proven that the defendant consented and agreed with the intent of the perpetrator to avoid taxation.

The Prosecution claims that Miskovic gave two alleged pieces of advice thus helping his son in committing criminal offence of tax evasion. The alleged advice, according to the statements contained in the indictment are the following: that a foreign legal entity “Mera BV” subscribe previously purchased shares as equity in a domestic legal entity “Mera d.o.o.”, and then that this domestic legal entity, namely “Mera d.o.o.” sell those shares to another domestic legal entity, i.e. “Nibens”.

The Prosecution claims that Miskovic gave two alleged pieces of advice thus helping his son in committing criminal offence of tax evasion. The alleged advice, according to the statements contained in the indictment are the following: that a foreign legal entity “Mera BV” subscribe previously purchased shares as equity in a domestic legal entity “Mera d.o.o.”, and then that this domestic legal entity, namely “Mera d.o.o.” sell those shares to another domestic legal entity, i.e. “Nibens”.

But the alleged advice do not represent the act of aiding and abetting in committing a criminal offence, the alleged advice are directed exclusively towards legal actions that are legal and permitted, compliant with all legal procedures, and by no means wrongful.

The abettor’s action should be in his contribution towards intentional committing a criminal act, and not of a permitted act. The abettor needs to know basic elements of a specific act, such as the act of execution, and result and causal connection between actions and consequences. It is necessary that the abettor is at least aware of the intent of the perpetrator to evade taxation.

Tax evasion is a type of fraudulent action towards the state and this fraud is carried out by fraudulent actions that jeopardize credibility, i.e. by misrepresentation, concealment, and the like. In this case, there was nothing hidden, everything was public and available to state authorities, primarily to the tax authority. All the evidence of the prosecution confirm that all the transactions described in the indictment were known to the authorities, and that they registered and controlled these actions (Business Registers Agency, Securities Commission of the Central Registry of Securities). The taxpayer fulfilled his duties by providing accurate and complete data and by filing the corresponding tax returns in connection with the tax events that occurred objectively, thus allowing the Tax Administration to fully consider all the elements of importance for taxation and to reach economic substance of the transaction, and therefore, to the determination of its dissimulated form. Please note that this is not about illegal tax evasion (which would per definitionem entail criminal liability /offence or criminal/), but about legitimate minimizing of tax payment. It is undisputed that the tax return was actually filed, but the prosecution claims that it was not filled in correctly. But even if the tax return was not filed, failure to submit tax returns does not per se mean that there is a intent to commit a criminal offense of tax evasion.

I have already said that the greatest achievements in the prosecution’s evidence are assumptions and here we reach the essence of the principle that is important to every citizen: In dubio pro reo – in doubt in favour of the defendant. The Prosecution assumes and performs logical thinking, however it fails to prove.

The essence of the principle of doubt in favour of the defendant is that facts to the detriment of the defendant must be fully proven, and the facts in favour of the defendant shall be taken as proven. If certain evidence are to the detriment of the defendant, then this evidence must be of such nature that the facts resulting from them are established in an undoubted way and that they are persuasive for a judge and that the judge does not doubt them. Therefore, if Mišković says “I was in Serbia at the time for which you are accusing me”, then this must be taken as proven if the Prosecution failed to prove the contrary.

Let’s have a look at aiding in the commission of a criminal offence. The prosecution failed to present and file a single evidence in support of such claim about the circumstances as to when, on what occasion, and in which way did Miroslav Mišković give the alleged advice to Marko Mišković. The Prosecutor’s Office takes as their proof the statement of Mišković given 6 months prior to the initiation of proceedings for tax evasion, distorting and deforming this statement by arguing that if Mišković gave business advice to his son, he would have probably thereby given him advice on how to evade taxation as well. But the prosecution failed to prove this.

We proposed everything, we brought the best that Serbia has in order to prove that the people who dealt with taxes in the company of Miroslav Miskovic’s son had reasons to believe that they had been acting according to the law. The evidence of the prosecution and defence clearly indicate that: not a single evidence shows that “Mera Investment Fund B.V” earned income; no evidence of the prosecution confirms that share contribution in Mera Invest d.o.o was actually transfer against compensation; evidence confirm that there was not any payment of funds by “Mera Invest d.o.o” to “Mera Investment Fund BV”; and no evidence confirming that there was any capital gain; evidence of the defence confirm that “Mera Investment Fund BV” earned no income. Capital increase in a single member company does not represent an exchange of rights against compensation.

With its very standpoint, the court defends the defendant because it has repeatedly stated that with regard to the existence of the tax liability there were “different views”; “different perception”; “different standpoints”; or “different way of thinking”. Although this statement of the Trial Chamber President is incorrect because at the time of the alleged commission, there was only one standpoint, i.e. that there was no tax liability, this view of the court can only point to the absence of Miroslav Miskovic’s intent to commit the offense of aiding in tax evasion, for the alleged tax obligation for which it is not known whether it exists at all. The Court asked the National Assembly whether there was any tax evasion, the prosecution asked the Ministry of Finance whether the tax actually existed, and the court also asked the Ministry of Finance if there were any taxes, and the applicant requesting authentic interpretation in his address to the Assembly also noted that there were different interpretations. And if all of you, in 2016, still do not know whether there was any tax liability in 2008, then why do you expect Marko and Mirosalav Miskovic to have known those things back in 2008, when neither the then professors, ministers, experts, and specialists had known that.

When it comes to the other criminal offense, for which Miskovic was arrested and for which he spent the first 6 months in detention under Article 234 of the CCRS, the essence of the Prosecution’s thesis is that by means of the Loan Agreement, Miroslav Mišković, as the founder of a foreign legal entity, became the owner of all road companies and secured gain in the form of loan interest, while his son Marko became a member of all road companies through capital increase and realized gain equal to the difference in the price of purchased and sold shares, and that they are all liable for damage which occurred a few years thereafter in the form of launching bankruptcy proceedings and freeze on assets of the road construction companies. For such a thesis, the prosecution provides a series of legal and factual inaccuracies because:

• Loan repayment is not a criminal act, especially when it comes to such a favourable loan.

• The risk of loan granting, that is of loan repayment is on the creditor’s side.

• CC RS does not provide for the possibility that a natural person owning money is responsible for granting loan to someone aware that this credit might not be repaid to him.

• Loan repayment before the scheduled deadline is also legally permitted.

• From the point of Miskovic’s responsibility, it is irrelevant how the loan is repaid.

• For each instalment, there is an approval issued by the National Bank of Serbia.

• Trading in shares on the stock exchange is allowed.

• Sale of shares at a higher price cannot represent a criminal offense of the entity selling shares.

• The law does not recognize the category of acquisition of controlling share through credit financing.

• Our law does not provide for an option of becoming an actual shareholder of all associated legal entities through loan agreement.

And here is what the prosecution has to say about all these actions for which they demand imprisonment for my client: “… it is a primarily loan agreement between “Hemslade Trading Limited” and PZP “Niš”, which in fact is legal, if viewed as a loan agreement, but on the other hand, it is important that the background of all these legal transactions is actually hidden……” and that, by their actions, each of which is also allowed, since the signing of consortium agreements or loan agreements, sales orders, representation at general meetings and so on, each of these actions is permitted, but not if their the ultimate goal as was the case here, and with the intention of actually tricking the law and creating the illusion that these are legally permitted activities, and what makes them illegal is actually their background and goal with which they were undertaken…”.

Therefore, the Prosecution indicates that Mišković acted in compliance with the law in case of both criminal offences. The Prosecution alleges that Miroslav Mišković acquired material gain in the form of interest. However, all these gains related to the Mišković family do not contain an element of illegality. Mišković cannot acquire unlawful gain through loan agreement. If a foreign company granted loan, and if that contracted loan was repaid, then there is no unlawful gain. In addition, there is not any unlawful gain if a foreign legal entity acquired gain through the difference between the purchase price and the selling price of shares. Why, this is the very essence of economic financial transactions in all the countries acknowledging the laws of market.

The Prosecution claims that the road companies suffered damage. Freeze on assets occurred in the period long after Marko and Miroslav Mišković withdrew from these road companies. Bankruptcy occurred 3 or 4 years after the Miškovićes left the road maintenance companies. Not a single action taken by the Miškovićes did lead to freeze on assets, bankruptcy or noncompliance with the privatization contracts.

Honourable judges, the Mišković case demonstrates the unwillingness of the prosecuting authorities to be objective for the purposes of political marketing. And impartiality is the responsibility of the prosecution. The applied formula is characteristic of legal political marketing: by creating the illusion that everything is resolved and that the evidence was collected. Numerous public statements by the representatives of the judiciary and legislative and executive power, as well as newspaper articles, imposed perception of the public that the arrest was justified and that the conviction is certain.

Honourable judges, the Mišković case demonstrates the unwillingness of the prosecuting authorities to be objective for the purposes of political marketing. And impartiality is the responsibility of the prosecution. The applied formula is characteristic of legal political marketing: by creating the illusion that everything is resolved and that the evidence was collected. Numerous public statements by the representatives of the judiciary and legislative and executive power, as well as newspaper articles, imposed perception of the public that the arrest was justified and that the conviction is certain.

Many times, we did not have the impression that Mišković is on par with other citizens before court, which is why your judgment surpasses the significance of a routine judgment in your daily work. Only your judgement of acquittal will convey a message that this is the judgment reached by you and not somebody else. It is necessary to give faith to every individual that judgments in Serbia can still be made in courts and not outside the court at the offices of those who are not judges. Today, one needs courage to enforce law. And enforcing law means acquitting Miroslav Miskovic.

(Enclosure as an integral part of the oral closing arguments – more than 200 pages of legal and factual analysis of the case material with quotes of witnesses and written evidence and legal comments and opinions)

Belgrade, Jun 9th 2016